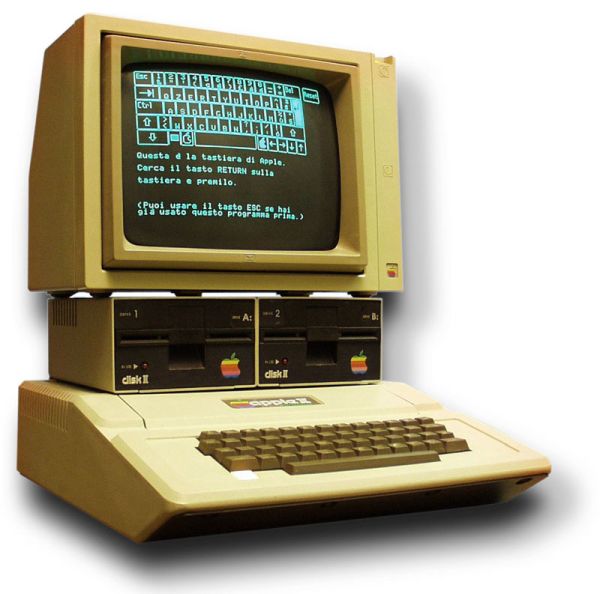

This morning, I was thinking about Apple. When I got started in this industry in the early 80s, it was on an Apple II+ writing first in BASIC and later in UCSD Pascal. I thought Apple was simply amazing, so it was tough watching the more than decade of decline before Jobs rejoined. Our industry has no memory and most great companies fade away. Sometimes this happens surprisingly quickly once the process has begun. Tandem, still one of the best database machines ever made, was eaten by DEC. DEC was eaten by Compaq. Compaq was eaten by HP. IBM took over the personal computer leadership from Apple and subsequently also fell from the top through a long period of decline. IBM eventually sold the client computer business to Lenovo and IBM continues to struggle to find growth with 20 consecutive quarters of declining revenues. Google and Amazon didn’t yet exist back then, and Oracle was just getting started.

Apple has done the impossible of hitting the top, losing touch with their customer base, and declining to near irrelevance before finding their way back to the top. Apple’s stock price has been high for years but the stock market gets excited (or depressed) in ways that are often disconnected from the success the company is actually achieving. To see how Apple was really doing, I looked up the world’s top 50 revenue producers to see where they stood: List of Largest Companies by Revenue.

Four observations jumped out while scanning the list. Of course the first is that Apple is at #9 on this list after having had a brush with corporate death. They now bring in more revenue than all companies on the planet except 1 retail, 1 electric utility, 4 oil and gas, and 2 car companies. Incredible and it just about never happens that a company comes back after having nearly faded away.

The second is that Walmart is still bringing in more revenue than any other company period. $482B. That’s ½ trillion dollars. Looking at the Gross Domestic Product of entire countries (all the finished goods and services produced by the country in a year), Walmart revenue when compared to country GDP would place just slightly behind Poland and well ahead of Belgium. A truly staggering number.

The third observation from reading the top 50 corporate revenue list is that most of the exciting companies you read about aren’t even on the list and, ironically, most of their competitors are. Tesla is perhaps the best example. Tesla is in the press daily and there is no question they are having a massive impact on the automotive world. Tesla brings in a respectable $7B annually while 7 of the world’s automotive companies bring in more than $100B. Revenue is obviously a trailing indicator. I’m not convinced the stock price is much better but it’s amazing, at least to me, how much revenue is being brought in by companies that really haven’t been innovating for quite some time.

A fourth observation is the massive amount of money spent on automobiles and related technology. 14 of the top 50 revenue producing companies in the world are from the automotive and oil and gas sectors. An extension of that observation is selling to consumers in general is always a huge opportunity. Even small profits times a very large multiplier can get impressively large.

Apple is a real outlier in many respects. One of my greatest regrets in my professional life is I never got a chance to meet Steve Jobs.

Yes, your reminiscing brought back my fond recollections of the Apple II I used back then, and of Steve Jobs for having brought us so many life-changing technologies and fun products. The very first computer I ever touched was a Unix box when I was yee-ole lad — my Uncle who worked at the famous Bell Labs took us there during one of their “family” days, and I got to play some interesting games they had running on their Unix boxes.

The second computer I ever touched was a TRS-80 (remember those!). But the third computer that I ever touched, and kept touching for years was the Apple II+. I learned to program on it, first in BASIC then in good-ole 6502 Assembly language, before moving on to “better” computers. This brings back grand memories of the start of computing, when an ordinary audio cassette player was used to store and load software — even before floppy drives were commonplace.

Important years of our lives.

Here’s what I gleaned from the “50 largest companies” list. To me, revenue is not as interesting since that does not correctly measure a company’s efficiency, staying power, profitability, or value to society. For example, while Walmart has the highest revenue, it also has the highest employee count (2.3 million!!). So, they are very inefficient with their resources — they have the third lowest revenue per employee (only $211K/employee). I will guess their profitability is similarly dismal due to this high overhead. However, they do employee many more people, though in very low-wage no-benefits jobs.

To come up with the leaders, I focused on revenue per employee, which put Fannie Mae at the top, generating over $15 million USD per FTE!!! Wow! Who says governments can’t be efficient? Ironically, this was the only government/state-owned enterprise in the top-half. The others (mostly Chinese) were in the bottom, in terms of both revenue and revenue/employee.

No matter how I sliced the list, Apple always came up in the top 5 (or top 10). Not to mention, it’s been the largest company (largest market capitalization) and had the highest net profitability worldwide for several years. This data shows it’s also rather efficient, and has had consistent long-term growth of around 25% per annum.

I would suggest looking at Return on Invested Capital (ROIC) as a measure of efficiency. You can achieve a high ROIC through either high margins or high asset turnover (actually having both is ideal). Walmart is a classic example of a low-margin, high-asset-turnover business. Using this lens, it is totally unjustified to call Walmart inefficient.

I agree that ROIC is an excellent measure of efficiency. On Walmart, I wouldn’t say they are inefficient. What I said was they bring in massive revenue and would look great even when compared to entire countries: “The second is that Walmart is still bringing in more revenue than any other company period. $482B. That’s ½ trillion dollars. Looking at the Gross Domestic Product of entire countries (all the finished goods and services produced by the country in a year), Walmart revenue when compared to country GDP would place just slightly behind Poland and well ahead of Belgium. A truly staggering number.”

Ohh, Apple][ – My Uncle donated me a “kit” of a ][e mimic (including all the docs from MOS and so on). Also with two 3″ (no, not 3.5″ :) ) A/B sided drives – made up a whooping 360kB of storage (“how am I supposed to ever fill that up?”)

Jobs did a great job in selling that and it’s sad he had to go that early – but please dont forget about Woz!

James, you’re one inspiring guy with all your work (I only have to think about the 2007 LISA paper and what happenend then with AWS after your flip).

Thanks a ton!

It’s cool you remember the Lisa paper. That was a fun one to bring together.

It’s kind of funny that the Apple II was fully populated at 48k — 64k with an expansion board — the processors was a single core running at only 1Mzh without even a hardware. The two tiny Raspberry Pi on my boat are both three orders of magnitude faster. All these Pis do in this application is, in aggregate, support 12 channels of digital output and around 30 channels of digital input. Just Ethernet connected sensors and actuator control.

The smartphone/internet has placed data everywhere it is valuable and useful.

Steve Jobs conceptualized a pentagon sized 4 story “temple” in Cupertino that cost around 5 Billion USD(the most expensive office in history). Mr. Jobs fleeced(in my opinion) the engineers of the Motorola Rokr and created the Apple nano(Ed Zander was known as the worst CEO ever for letting Mr. Jobs into company secrects, at least.)

The petrochemicals industry(and its derivatives) of course supports the vehicles industry which in turn supports the military industrial complex. It is suprising to observe Sino SOEs(State Owned Enterprises) in the top ten but that is China. Amazon’s share price since 2015 is up 173% and its market capitalisation is around 400Billion USD. Is it not in the top ten for value(not revenue)?Even the CIA uses AWS! Ahem, got any niche uses for a Fire Phone?